|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

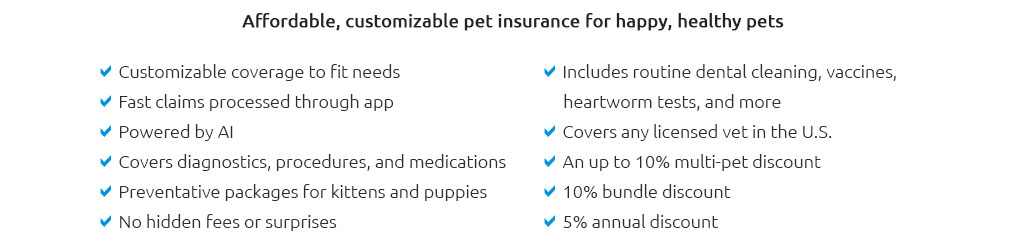

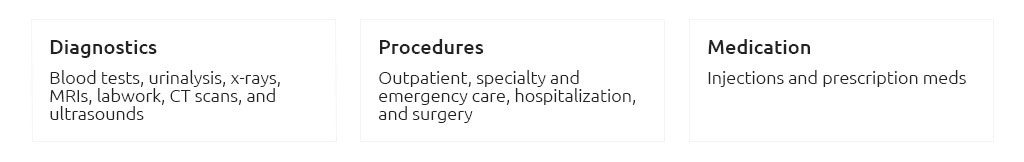

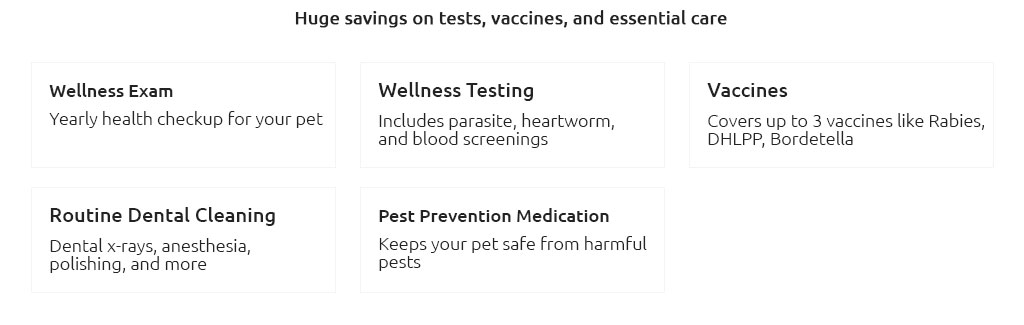

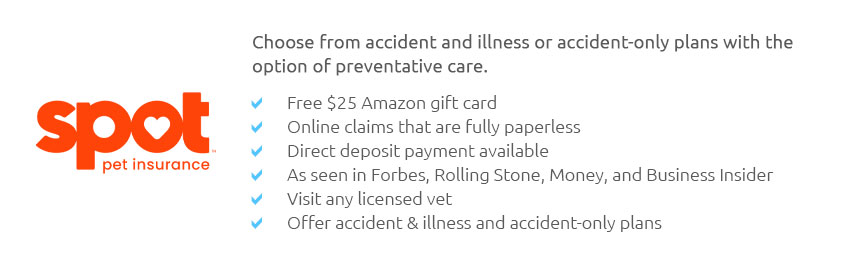

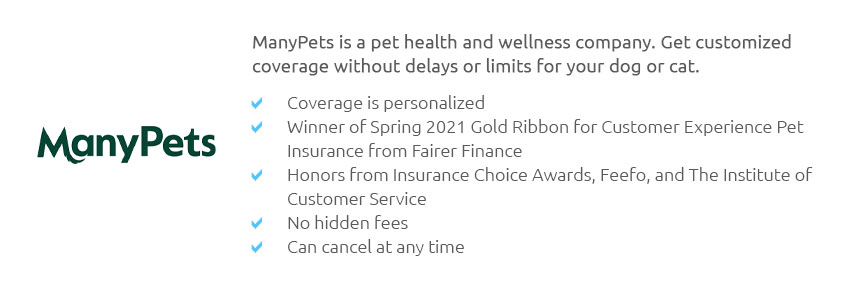

Best Value Pet Insurance Plans: A Comprehensive GuideIn the modern age of pet ownership, ensuring the well-being of our furry companions goes beyond regular vet visits and nutritious diets. As veterinary costs rise, pet insurance has emerged as a prudent choice for pet owners looking to safeguard their finances while providing top-notch care for their beloved animals. But with a plethora of options available, how does one discern the best value pet insurance plans? Pet insurance, much like health insurance for humans, is designed to cover unforeseen medical expenses that can arise from accidents, illnesses, and even routine care. While some pet owners may initially balk at the thought of monthly premiums, the long-term benefits often outweigh the costs, especially when unexpected veterinary bills can run into thousands of dollars. Therefore, understanding what constitutes the best value in pet insurance is paramount. Firstly, consider the coverage options. A comprehensive plan should ideally cover accidents, illnesses, surgeries, and medications. Many plans offer additional benefits such as dental care, alternative therapies, and even behavioral treatments. It’s wise to scrutinize what each plan includes and, perhaps more importantly, excludes. Pre-existing conditions are typically not covered, so enrolling your pet while they're young and healthy can be beneficial. Another crucial aspect is the cost of premiums. Premiums can vary significantly based on factors such as the pet’s age, breed, and location. While it may be tempting to opt for the cheapest plan available, it’s important to balance cost with coverage. Often, plans with lower premiums come with higher deductibles or less comprehensive coverage, which could lead to higher out-of-pocket expenses in the event of a claim. Additionally, the reimbursement model is a vital consideration. Some insurers offer a percentage-based reimbursement, typically ranging from 70% to 90% of the vet bill, after the deductible has been met. Others offer a benefit schedule that provides a set reimbursement amount for each condition or procedure. Understanding the reimbursement model can help pet owners gauge potential out-of-pocket costs more accurately. Customer service and claim processing are also essential factors. The best value pet insurance plans often come from companies that offer excellent customer service and efficient claim processing. Reading reviews and seeking recommendations from other pet owners can provide insights into an insurer’s reputation. To offer a broader perspective, let’s delve into some of the top contenders in the market. Healthy Paws is frequently lauded for its comprehensive accident and illness coverage, without any caps on payouts. Its seamless claim process and quick reimbursements are a hit among pet owners. Embrace Pet Insurance offers a unique diminishing deductible feature, rewarding no-claim years by reducing the deductible. Lemonade Pet Insurance, known for its user-friendly app and fast claim settlements, offers competitive pricing with flexible coverage options. Ultimately, the best value pet insurance plan is one that aligns with your financial situation and your pet's specific needs. It should provide peace of mind, knowing that your pet's health is secured without breaking the bank. Investing time in research and understanding the intricacies of each plan can lead to informed decisions and long-term satisfaction. Frequently Asked QuestionsWhat is the primary benefit of having pet insurance? The primary benefit of pet insurance is financial protection against unexpected veterinary expenses, ensuring your pet receives necessary medical care without causing financial strain. Do pet insurance plans cover routine check-ups? Most standard pet insurance plans do not cover routine check-ups, although some insurers offer wellness plans or add-ons that include preventive care services. Is there an age limit for enrolling pets in insurance? Many insurers have age limits for enrollment, typically not accepting pets over a certain age, often around 10-14 years, though this varies by company and policy. How do I determine the best plan for my pet? Consider factors such as your pet’s breed, age, common health issues, and your budget. Compare coverage options, deductibles, and reimbursement rates from various providers to find the best fit. Are pre-existing conditions covered by pet insurance? Pre-existing conditions are generally not covered by pet insurance plans. It’s advisable to enroll pets while they are young and healthy to avoid these exclusions. https://www.embracepetinsurance.com/

Playful white dog mid-jump with mouth open, reaching for a vibrant green and. Forbes Advisor w stars. money- ... https://www.aspcapetinsurance.com/research-and-compare/compare-plans/compare-pet-insurance-plans/

comparing pet insurance plans for your cat or dog ; Yes, No, Yes ... https://www.healthypawspetinsurance.com/

The top-rated cat insurance & dog insurance plans cover accidents, illnesses, cancer, emergency care, genetic and hereditary conditions, breed-specific ...

|